The global banking industry is rapidly transforming as digital services become the new standard for customer engagement. Traditional onboarding processes that rely on in-branch visits, physical documentation, and manual verification are increasingly seen as inefficient and outdated. To meet modern regulatory requirements while delivering seamless customer experiences, banks are adopting Video KYC and digital address verification solutions. These technologies are redefining how banks verify identities, prevent fraud, and build long-term customer trust.

Video KYC: A Digital Shift in Banking Onboarding

Video KYC allows banks to verify customer identities through secure video interactions, either in real time or via recorded sessions. During this process, customers present official identification documents, complete facial verification, and undergo liveness checks to confirm authenticity. This digital approach ensures that banks remain compliant with KYC, AML, and CDD regulations while eliminating the need for physical branch visits. Video KYC enables faster onboarding and allows banks to expand their reach to customers in remote and underserved areas.

The Importance of Address Verification in Banking

Address verification is a critical component of the banking KYC process. Banks are required to confirm a customer’s residential address to assess risk, prevent financial crime, and meet regulatory obligations. Digital address verification replaces manual checks with technology-driven validation methods, ensuring higher accuracy and efficiency. By verifying addresses digitally, banks can reduce errors, minimize fraud, and maintain up-to-date customer records without unnecessary delays.

Why Banks Are Embracing Video KYC Solutions

Banks are increasingly turning to Video KYC to balance compliance with customer convenience. One of the primary drivers is the need to reduce onboarding time while maintaining strict regulatory standards. Video KYC significantly lowers operational costs by reducing dependency on branch staff and manual reviews. At the same time, biometric verification and live video interactions strengthen security and reduce identity theft. This combination of efficiency and safety makes Video KYC an ideal solution for modern banking operations.

Digital Address Verification Methods in Banking

Banks use multiple digital methods to verify customer addresses, ensuring accuracy and compliance. These methods include document verification using utility bills or bank statements, video-based address confirmation during Video KYC sessions, and cross-checking information with government or credit bureau databases. Advanced solutions also leverage geolocation data and automated address matching to validate customer information in real time. This layered approach enhances reliability while reducing onboarding friction.

The Role of Artificial Intelligence in Banking KYC

Artificial intelligence has become a core component of Video KYC and address verification systems in banking. AI enables automated document analysis, facial recognition, and liveness detection, reducing the risk of human error. Machine learning algorithms help identify suspicious behavior, detect forged documents, and flag high-risk customers. By automating these processes, banks can maintain consistent compliance across large customer bases while scaling their digital operations efficiently.

Enhancing Customer Experience Through Digital Verification

Customer expectations have shifted toward fast, remote, and hassle-free banking services. Video KYC improves the overall customer experience by allowing users to complete verification from their homes using smartphones or computers. Reduced paperwork, quicker approvals, and transparent verification steps lead to higher customer satisfaction. For banks, this improved experience translates into better conversion rates and stronger customer loyalty.

Security and Data Privacy Considerations

Banks manage highly sensitive customer data, making security and privacy a top priority in digital verification processes. Video KYC platforms must comply with strict data protection regulations and use encrypted communication channels to safeguard information. Secure cloud infrastructure, access controls, and audit trails are essential to ensure regulatory compliance and customer confidence. Strong cybersecurity frameworks help banks protect against data breaches and maintain trust in digital onboarding systems.

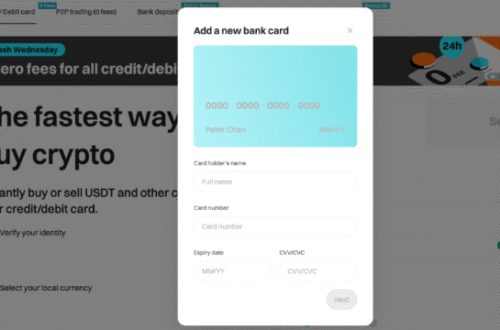

Use Cases of Video KYC and Address Verification in Banking

Video KYC and digital address verification are widely used across banking services, including account opening, loan and mortgage processing, credit card issuance, and digital banking enrollment. These technologies are also increasingly used for periodic KYC updates, ensuring customer information remains accurate over time. By applying Video KYC across multiple use cases, banks can standardize compliance while improving operational efficiency.

Overcoming Implementation Challenges

Despite its benefits, implementing Video KYC in banking comes with challenges such as integrating with legacy systems, obtaining regulatory approvals, and addressing varying levels of customer digital literacy. Banks overcome these obstacles through phased implementation, staff training programs, and customer education initiatives. By gradually transitioning to digital verification, banks can minimize disruption while maximizing long-term benefits.

The Future of Video KYC and Address Verification in Banking

The future of banking KYC lies in continuous monitoring and advanced digital identity solutions. Emerging technologies such as biometric-only authentication, blockchain-based digital identities, and cross-border KYC interoperability are expected to further enhance security and efficiency. As regulations evolve and digital adoption increases, Video KYC and address verification will remain central to banking innovation.

Conclusion

Video KYC and address verification are transforming the banking industry by enabling secure, compliant, and customer-centric onboarding processes. These technologies allow banks to meet regulatory demands while improving efficiency and customer satisfaction. As digital banking continues to grow, Video KYC will play a vital role in building resilient, trusted, and future-ready banking ecosystem